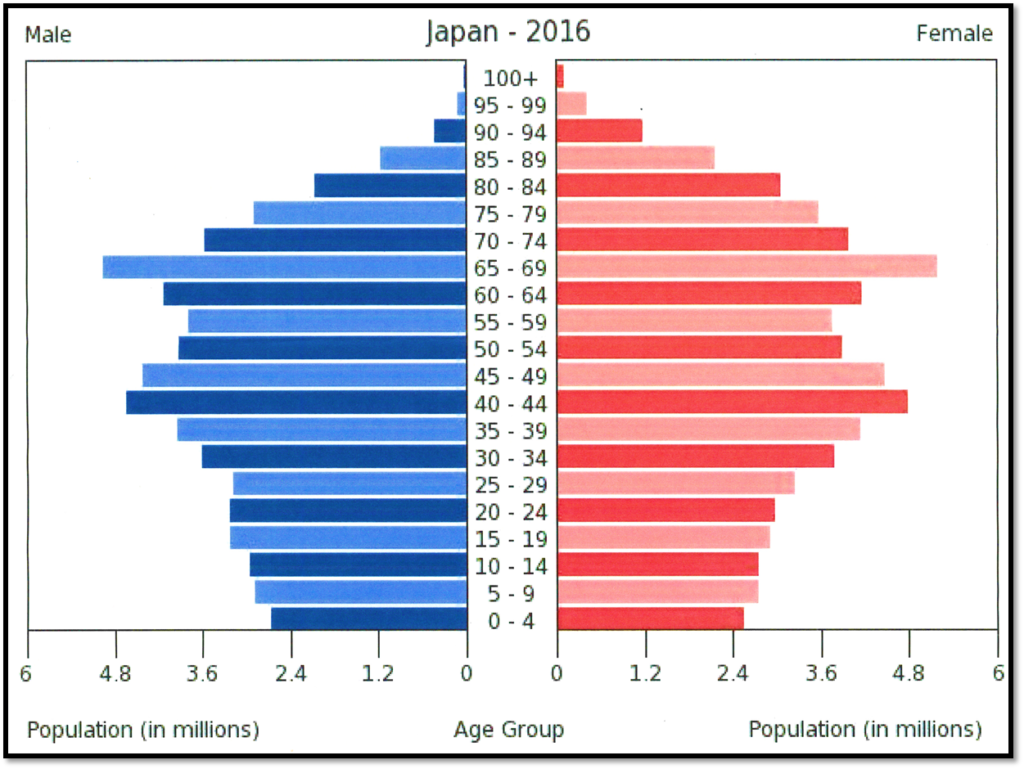

The over-optimistic analysts at Wall Street have done it again! It seems at the top of every cycle they project earnings to go straight up, which is what part of what creates such a shock for the market once the economy goes into a slow down or recession. It is inconceivable, in my opinion, that earnings could bounce screaming upward in this slow growth economy globally which is set to contract. See BCA comments below:

“According to BIS data, global credit growth is contracting. That is significant, because credit greases the wheels of the global economy. Corporate profit margins are already narrowing, but bottom up forecasts discount an aggressive move out to new highs in the coming quarters (middle panel). The growth backdrop is not conducive to such a development. Specifically, cyclical sectors such as industrials, materials, energy and technology are slated to show broad-based improvement in profitability. That would not be far-fetched if the world were on the cusp of a V-shaped, post-recession type of acceleration. However, deleveraging and the global credit contraction warn that global growth is not about to rebound.” (Source: BCA, U.S. Equity Strategy, 6/21/16)

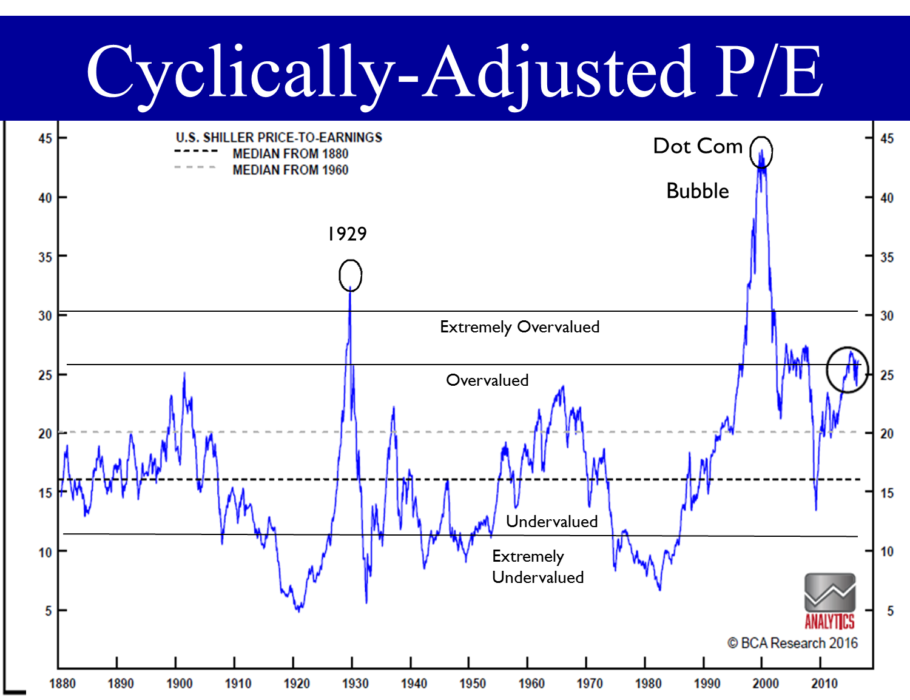

Source: BCA Research 2016